===

The topic of provincial debt levels in Canada 2024 is critical as it influences not just the economy but also the daily lives of Canadian citizens. With growing concerns about fiscal sustainability, understanding the nuances of provincial debt is imperative for stakeholders ranging from policymakers to taxpayers. The rising debt can feel like a looming specter, threatening social services, infrastructure, and economic stability. This article delves into the current state of provincial debt, revealing essential insights, trends, and factors that are defining the financial landscape across Canada this year.

Understanding Provincial Debt Trends Across Canada in 2024

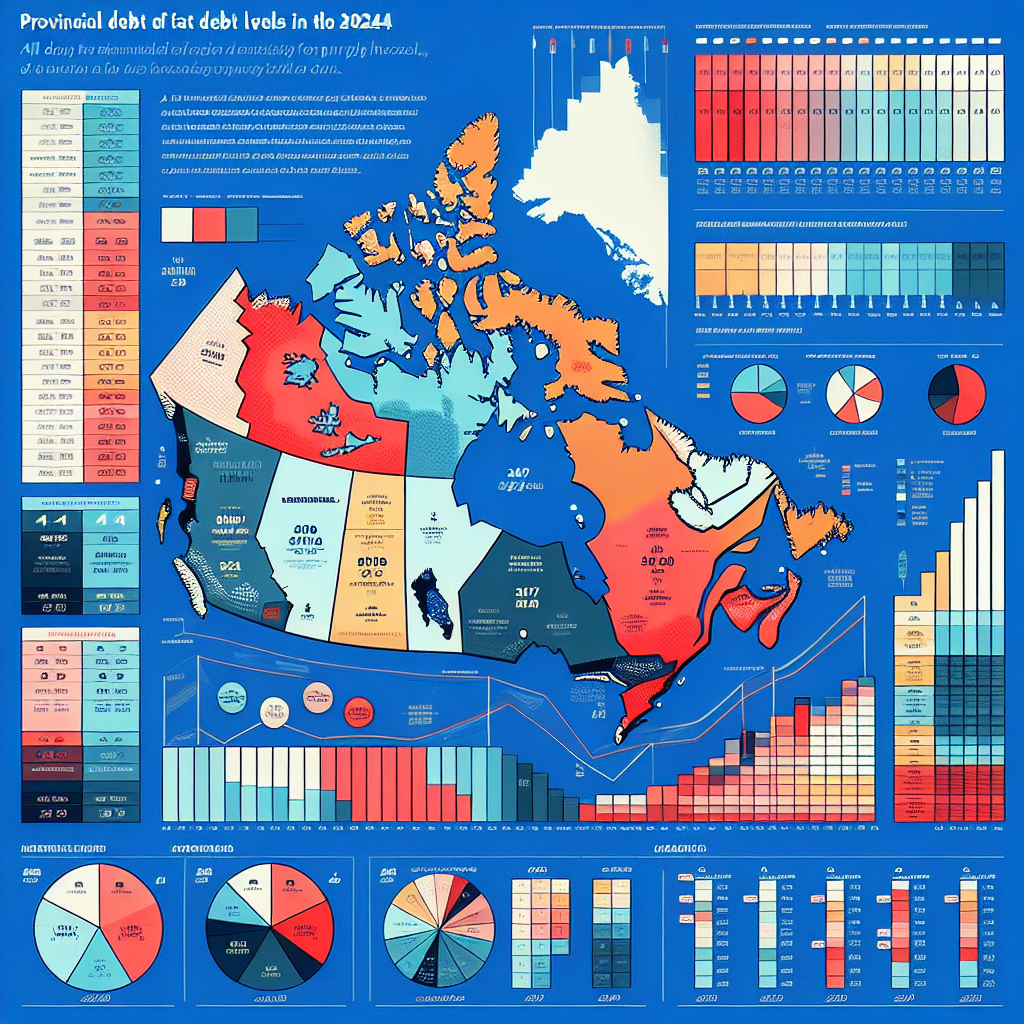

In 2024, provincial debt levels in Canada have reached a pivotal stage, marked by both alarming increases and significant regional disparities. Recent statistics indicate that the aggregate debt across provinces has surpassed previous records, primarily fueled by the repercussions of the global pandemic and ongoing inflation pressures. Notably, provinces such as Ontario and Quebec continue to dominate the debt landscape, accounting for a substantial portion of the national total. The implications of this rising debt are far-reaching, affecting everything from social programs to investment in public infrastructure.

A closer examination reveals that while some provinces are grappling with ballooning debt levels, others like Alberta and British Columbia are implementing effective fiscal strategies to stabilize and potentially reduce their liabilities. This divergence raises critical questions about interprovincial equity and the long-term sustainability of differing financial approaches. The current debt-to-GDP ratios serve as a crucial indicator, providing insights into not just the levels of debt, but also how well provinces can manage their obligations relative to their economic output. This year, the overall picture of provincial debt presents both challenges and opportunities for reform.

As the Canadian economy continues to navigate a post-pandemic recovery, the need for transparent financial assessments becomes increasingly urgent. Citizens, businesses, and investors alike are keenly interested in understanding not just where the debt stands, but also how it impacts future economic growth. This is a time for comprehensive analysis and dialogue—one that transcends simple statistics and encourages proactive engagement with provincial governments to ensure that debt remains manageable and does not hinder developmental progress.

Key Factors Influencing Provincial Debt Levels This Year

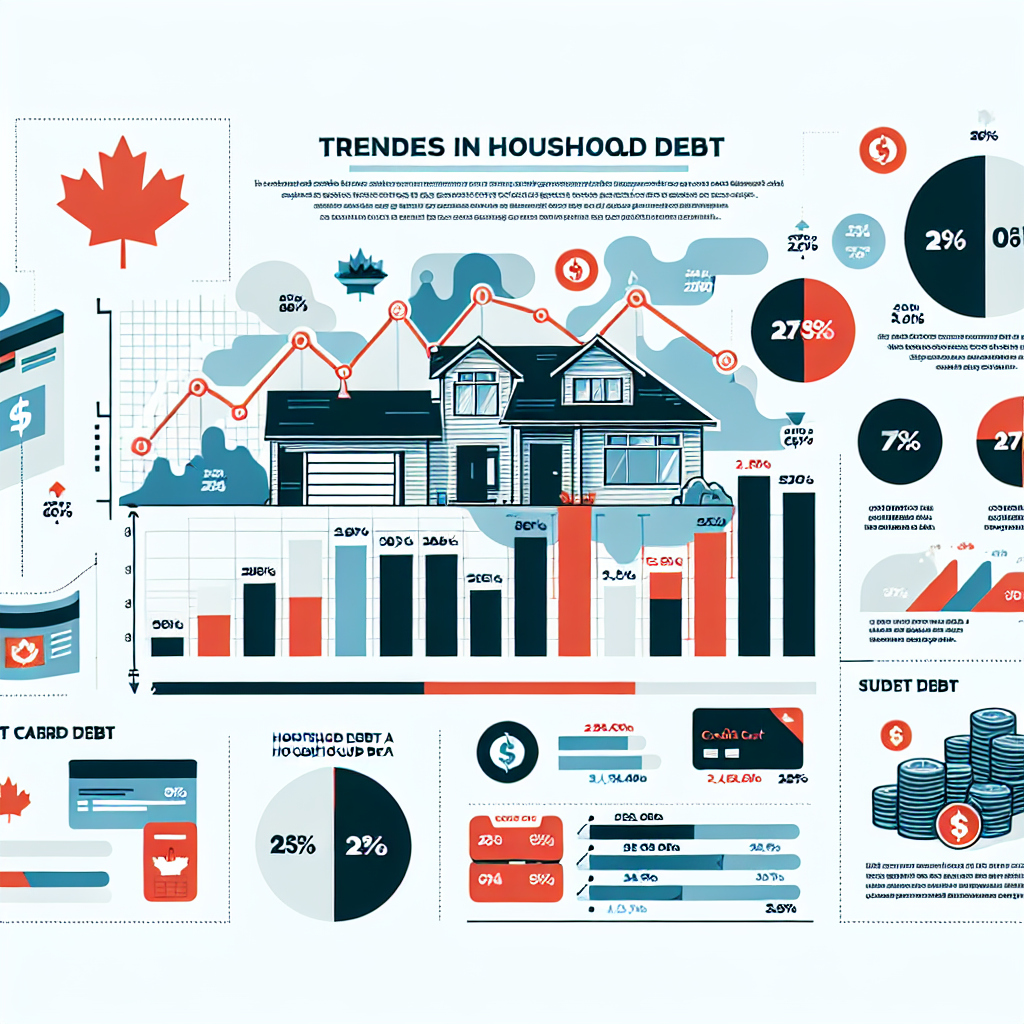

Several critical elements are shaping the conversation around provincial debt levels in Canada in 2024. The ongoing impact of inflation, particularly in the wake of global supply chain disruptions, has elevated operational costs for provincial governments. This scenario is further complicated by rising interest rates, which not only increase the cost of borrowing but also place additional strain on existing debt loads. Such economic conditions create a challenging environment for fiscal management, necessitating innovative approaches to budgetary constraints and public spending.

Another significant factor is the changing demographics across provinces. Aging populations in places like Newfoundland and Labrador exacerbate pressures on healthcare and pension systems, compelling governments to allocate more funds toward these essential services. This often results in a trade-off, where investment in other critical areas such as education and infrastructure may be neglected. The balance between maintaining public welfare and pursuing economic growth is delicate and requires astute policy decisions to ensure that burgeoning debt levels do not compromise long-term stability.

Moreover, the province-specific economic recovery trajectories play a crucial role in shaping debt levels. Provinces with diversified economies and robust job growth are better positioned to manage their debts effectively. Conversely, those reliant on single industries face greater risks, making them more vulnerable to financial downturns. In 2024, the focus should be on reassessing revenue streams, exploring alternative funding mechanisms, and fostering economic resilience through diversification, ensuring that the burden of debt does not stifle progress.

===

In conclusion, the analysis of provincial debt levels in Canada 2024 reveals a complex interplay of economic factors, demographic challenges, and regional disparities. As the nation emerges from the shadows of the pandemic, it is crucial to foster dialogue and transparency around fiscal policies that affect all Canadians. The insights gained from this analysis serve as a call to action for policymakers and citizens alike to engage in meaningful discussions about financial sustainability. By understanding these nuances, we can better navigate the path ahead, ensuring that provincial debt levels do not impede the prosperity of future generations. Engaging with local leaders, advocating for sound fiscal policies, and remaining informed are steps everyone can take to contribute to a healthier economic landscape.

Analyzing the Impact of Inflation on Canadian Debt in 20242024 Outlook: Debt Servicing Costs for Canadian HouseholdsAnalyzing Corporate Debt Trends in Canada: 2024 InsightsRelevant LinkRelevant LinkRelevant Link