In the ever-evolving economic landscape of 2024, the impact of inflation on Canadian debt stands at the forefront of national fiscal discussions. As prices rise, Canadians are left grappling with the implications of increasing debt burdens. Understanding the intricate relationship between inflation and debt is crucial for policymakers, investors, and citizens alike. This article delves into how inflation shapes Canada’s debt scenario, illuminating the critical factors influencing this relationship and offering profound insights into navigating these turbulent waters.

Understanding the Dynamics of Inflation and Canadian Debt in 2024

Inflation serves as both a boon and a bane for national economies, and in 2024, its effect on Canadian debt cannot be overstated. A rise in inflation typically leads to an increase in interest rates, as the Bank of Canada responds to curb spending and stabilize prices. This dynamic can elevate the cost of servicing existing debt, forcing the government to allocate more funds to interest payments rather than essential services. Consequently, the overall fiscal health of the nation becomes jeopardized, exacerbating the challenges faced by both public and private sectors.

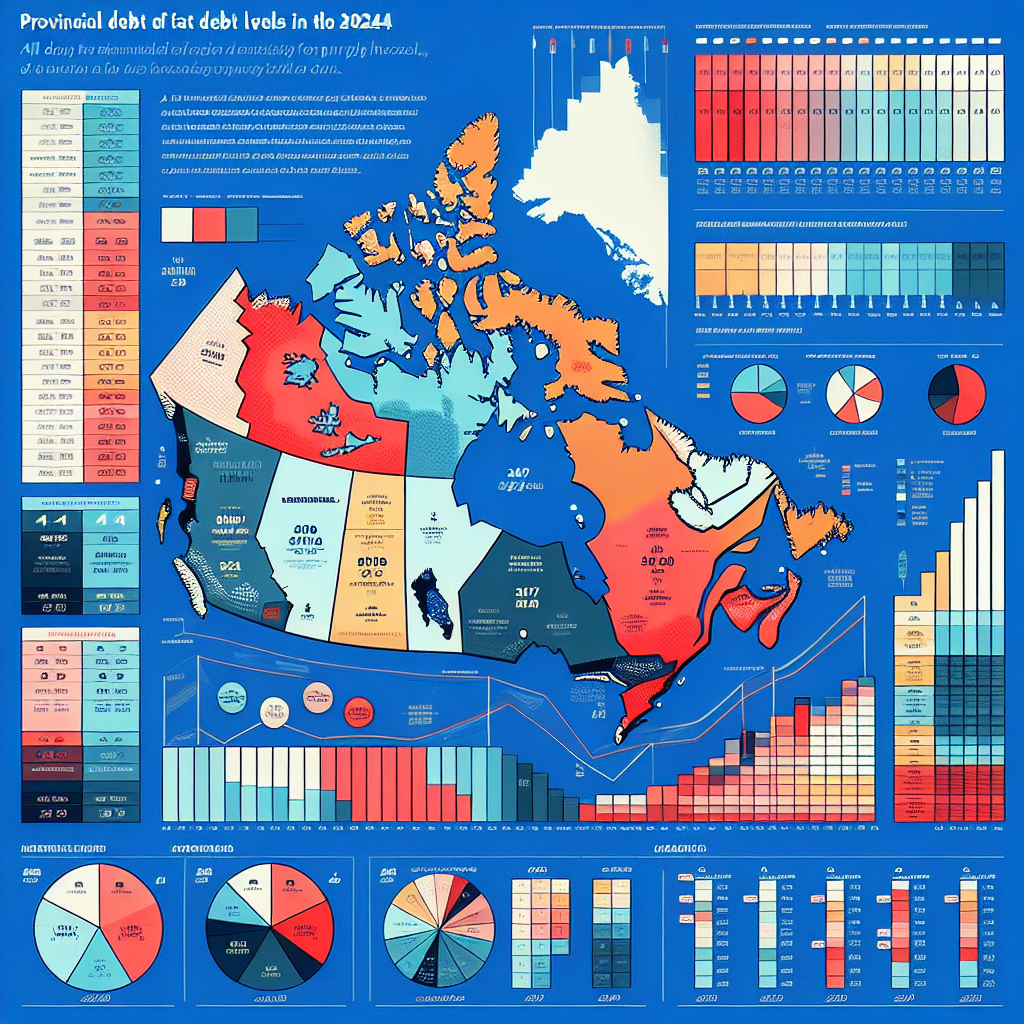

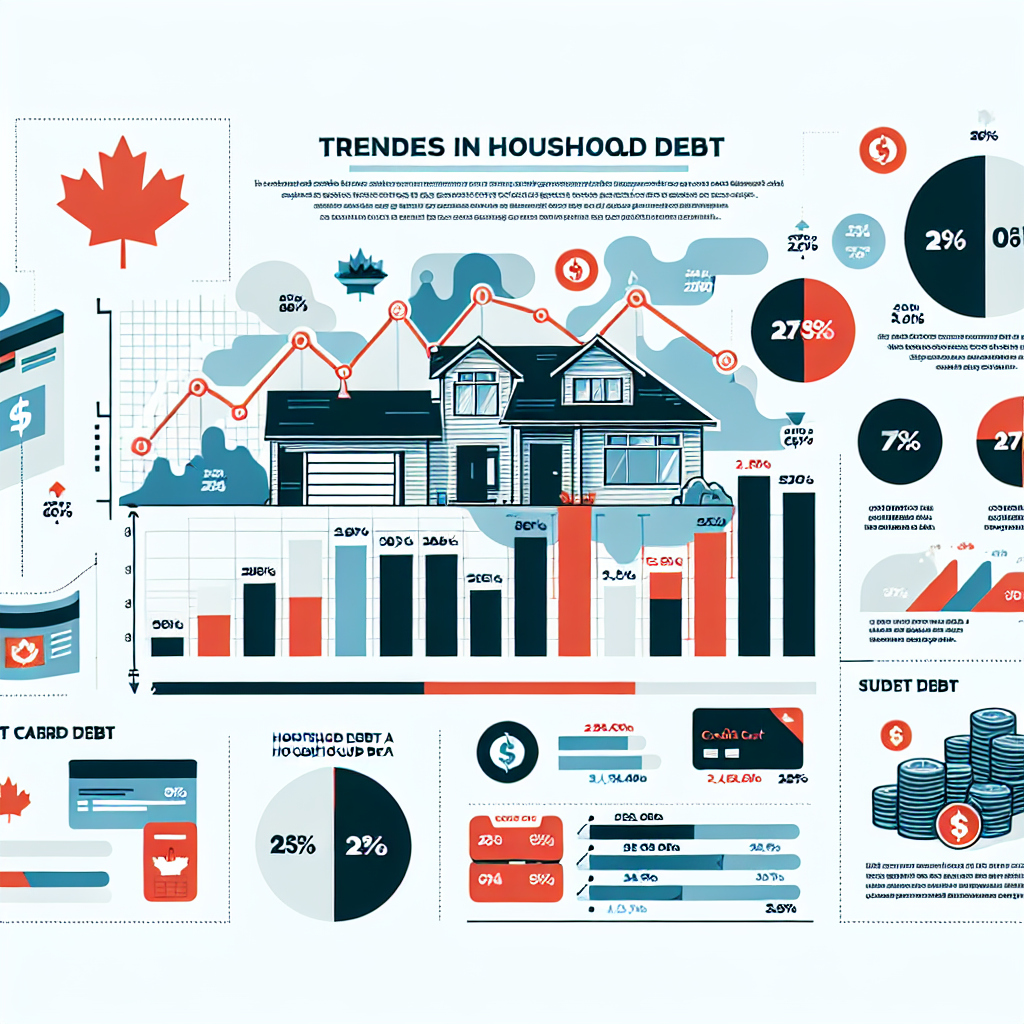

As inflation continues to unfold, the Canadian government’s debt levels, which are already substantial, face mounting pressure. The ratio of debt-to-GDP is an essential metric that reflects how comfortably a nation can manage its debt. If inflation outpaces GDP growth, this ratio can worsen, further straining the country’s economic resilience. Citizens might feel the pinch, as inflation erodes purchasing power, making it increasingly difficult for households to manage their finances amid rising costs.

Moreover, the real burden of debt can shift as inflation rises. While nominal debt amounts may remain unchanged, the effective value of that debt diminishes in a high-inflation environment. This paradox can lead to an illusion of improved fiscal standing for the government; however, a deeper analysis reveals that the true costs of inflationary pressures can lead to fiscal irresponsibility and long-term economic instability.

Key Factors Influencing Canada’s Debt Landscape Amidst Inflation

Several critical factors converge to shape Canada’s debt landscape against the backdrop of inflation. First and foremost, monetary policy plays a pivotal role. In 2024, the Bank of Canada’s decisions regarding interest rates will significantly impact debt financing costs for both the government and consumers. As rates rise, the cost of borrowing increases, leading to a tightening of financial conditions that may stifle economic growth. This scenario creates a vicious cycle, where higher debt costs lead to reduced public spending, further exacerbating economic challenges.

Another significant influence is the global economic environment. In 2024, Canada finds itself in a complex interplay of international trade relations and commodity prices. With the Canadian economy heavily reliant on exports, fluctuations in global demand can drastically affect revenue streams. If inflation persists while export prices remain stagnant, the government may struggle to maintain fiscal balance. This situation can lead to an increased reliance on debt to fill budgetary gaps, compounding the long-term effects of inflation on the economy.

Furthermore, demographic trends in Canada are an underpinning factor that cannot be overlooked. With an aging population, healthcare and social services demand is increasing. As inflation drives up the costs of these essential services, the government faces pressure to fund these initiatives through debt. Without a sustainable growth strategy paired with a responsible approach to debt management, the country risks falling into deeper financial jeopardy as inflation continues to challenge economic stability.

Understanding the impact of inflation on Canadian debt in 2024 is not merely an academic exercise; it is a pressing concern for every Canadian. As policymakers grapple with the multifaceted implications of rising prices, it is vital for citizens to remain informed about how these economic shifts can affect their lives. By staying ahead of the curve and engaging with expert analyses, Canadians can better navigate the financial landscape and advocate for policies that promote sustainable growth. Join the conversation, and let’s explore together how to safeguard the future of our economy amidst these challenging times.

2024 Outlook: Debt Servicing Costs for Canadian HouseholdsAnalyzing Corporate Debt Trends in Canada: 2024 InsightsAnalyzing Household Debt Trends in Canada: 2024 OverviewRelevant LinkRelevant LinkRelevant Link